Prices are up in New Canaan and throughout Fairfield County. Interest rates are now up over 7% and we cannot ignore the effect that decreased affordability is having and could have on the New Canaan market. Certainly, it is causing many would-be buyers to sit on the sidelines and wait for interest rates to drop. Some of them are exhausted, burnt out from bidding wars and others are reading the ticker, trying to time the market, waiting for interest rates to drop. My advice is do not wait. As interest rates drop more competition will enter the market, driving prices up further. According to the National Association of Realtors, “A lower mortgage rate brings down the monthly payment for a home loan. If rates drop to 6% (from current rates of 6.27%), 3.1 million more households will once again be able to afford to buy the median-priced home compared to the beginning of the year.” Eric Finnigan of John Burns Real Estate Consulting describes the full effect, saying “The number of households that could afford a $400,000 mortgage shrank by 24 million when mortgage rates rose from 3% to 7% in the past year”

The number of households that could afford a $400,000 mortgage shrank by 24 million when mortgage rates rose from 3% to 7% in the past year

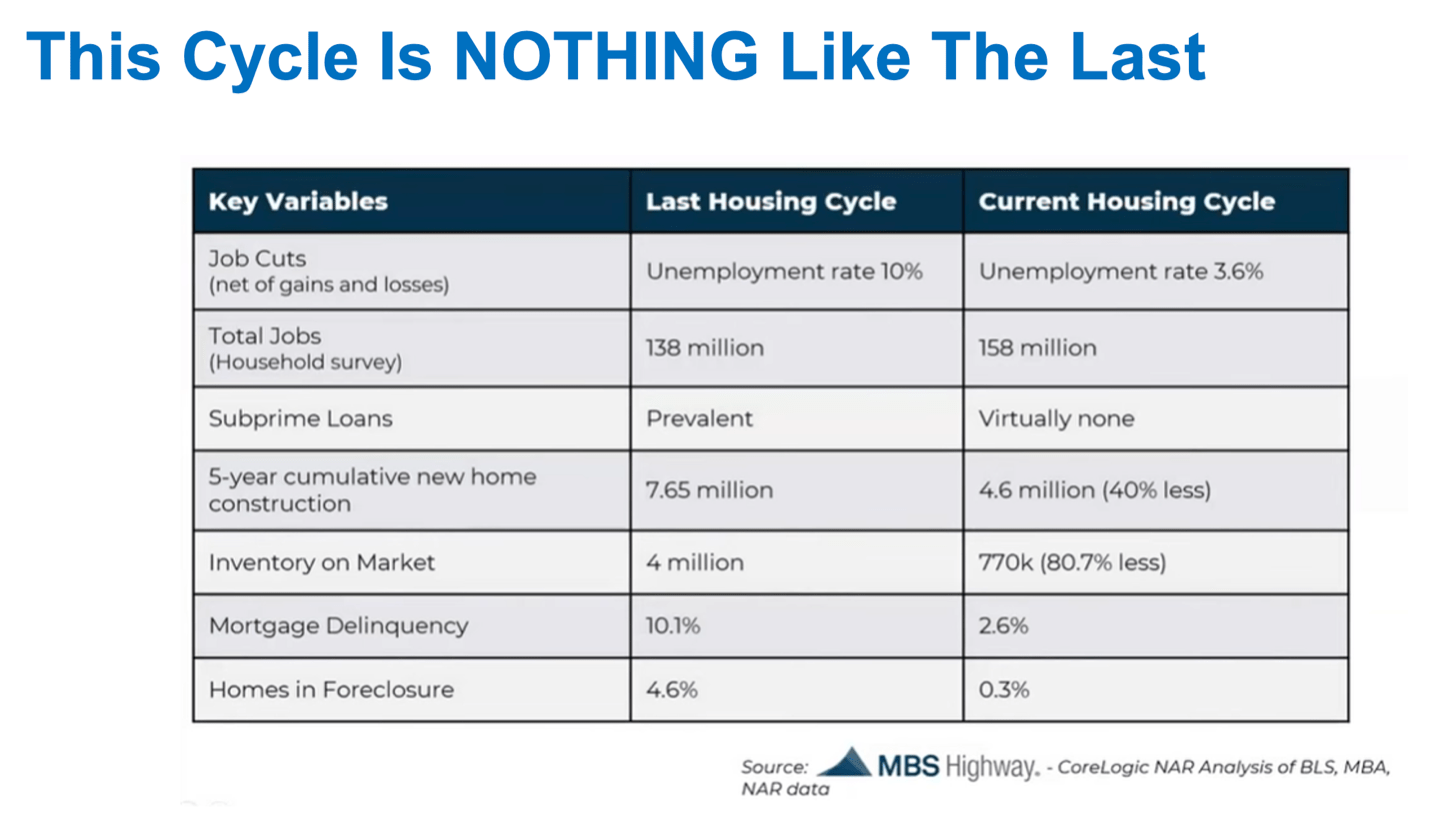

Is there a risk that the U.S. might enter a recession, causing a correction in the housing market? The Fed does not think so, as we see in the first chart, “This Cycle Is NOTHING Like The Last”:

The most important factor underpinning the housing market is always jobs. Demand sets pricing. We put listings out there and it sells when demand responds. Without jobs there is no demand. For the last few years, and for the foreseeable future, job numbers are strong. While wages might not be keeping pace (with inflation and housing costs in particular) the fact is the nation is nearly fully-employed. Here in New Canaan we depend on New York and the Finance industry in particular for many of those high-paying jobs that support our housing prices. We have to ask ourselves if the job market in New York City, and particularly Wall Street earnings, will remain strong, strong enough to support housing prices which now average close to $2 million dollars. According to PropertyClub.com to afford a $2 million home you should earn $450,000. To afford a $3 million home you should earn $700,000 per year. If you are a New Canaan area homeowner thinking about selling you should be encouraged that the jobs data is strong nationally, and regionally, and that while many of the high-paying jobs and wealthy buyers might have moved to more affordable states like Florida, Texas and the Carolinas the price appreciation in those markets has been even more dramatic and many of them are returning. Rents and prices in New York City are trending up, adding more pricing pressure to Fairfield County. Other factors in “This Cycle Is Nothing Like The Last” are related to foreclosure risk and inventory, both of which are expected to remain low.

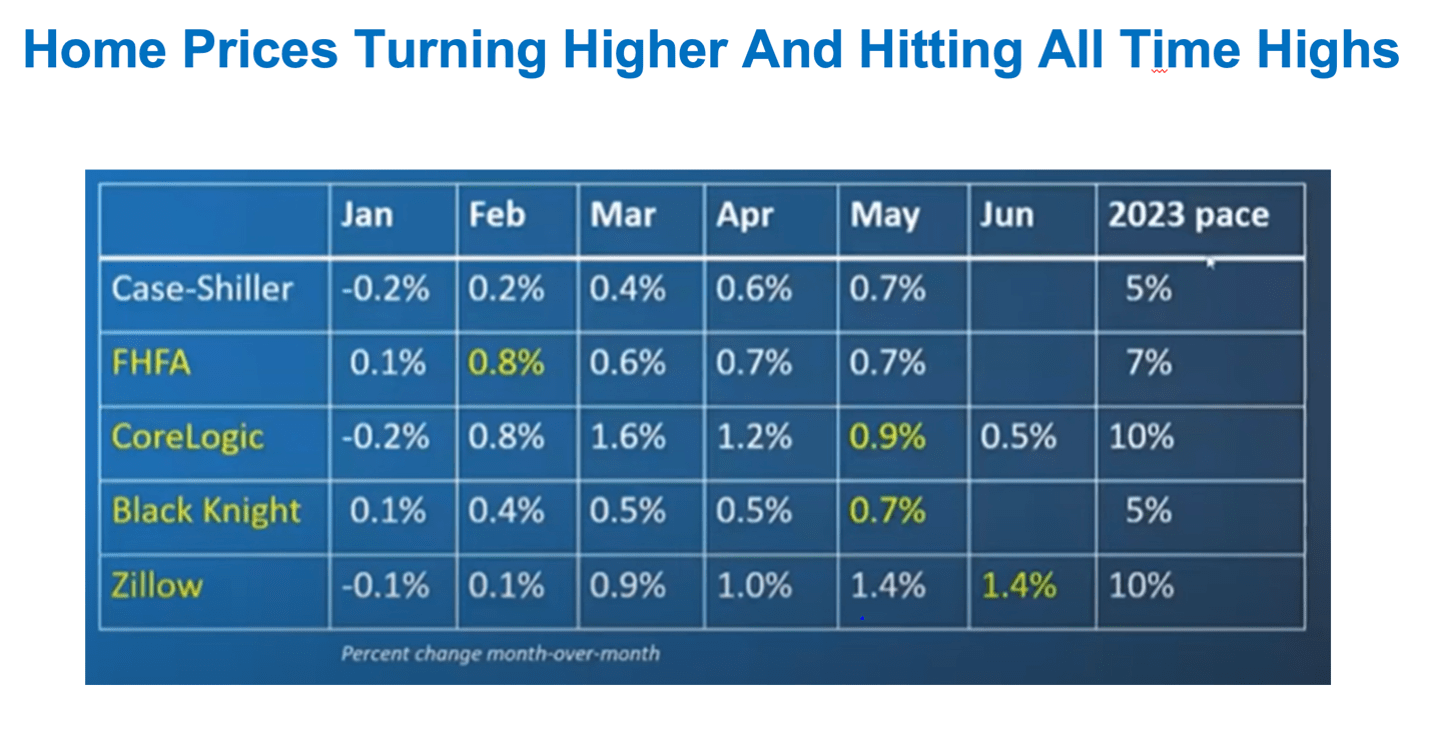

In the second chart (below), we see five major indexes projecting price appreciation in 2023 to be between 5% and 10%. While there are a few months in which we saw numbers falter in reaction to rising interest rates and uncertainty in the economy, the general trend is upward. Is price appreciation of between 5% and 10% realistic? Yes, it is in fact typical.

In the third chart, “Real Estate has a 90% Win Rate” (below), we see that yes, in fact, real estate appreciation of 5% to 10% is probable when we look at its performance since 1942.

The real estate market has been up 73 years and been down only 6 years. The 2007 crisis is responsible for 5 of those 6 negative years. While the 19% appreciation we saw in 2021 is outstanding, double digit price appreciation is more common than negative returns, occurring 17 times overall and 7 times in the last 20 years.

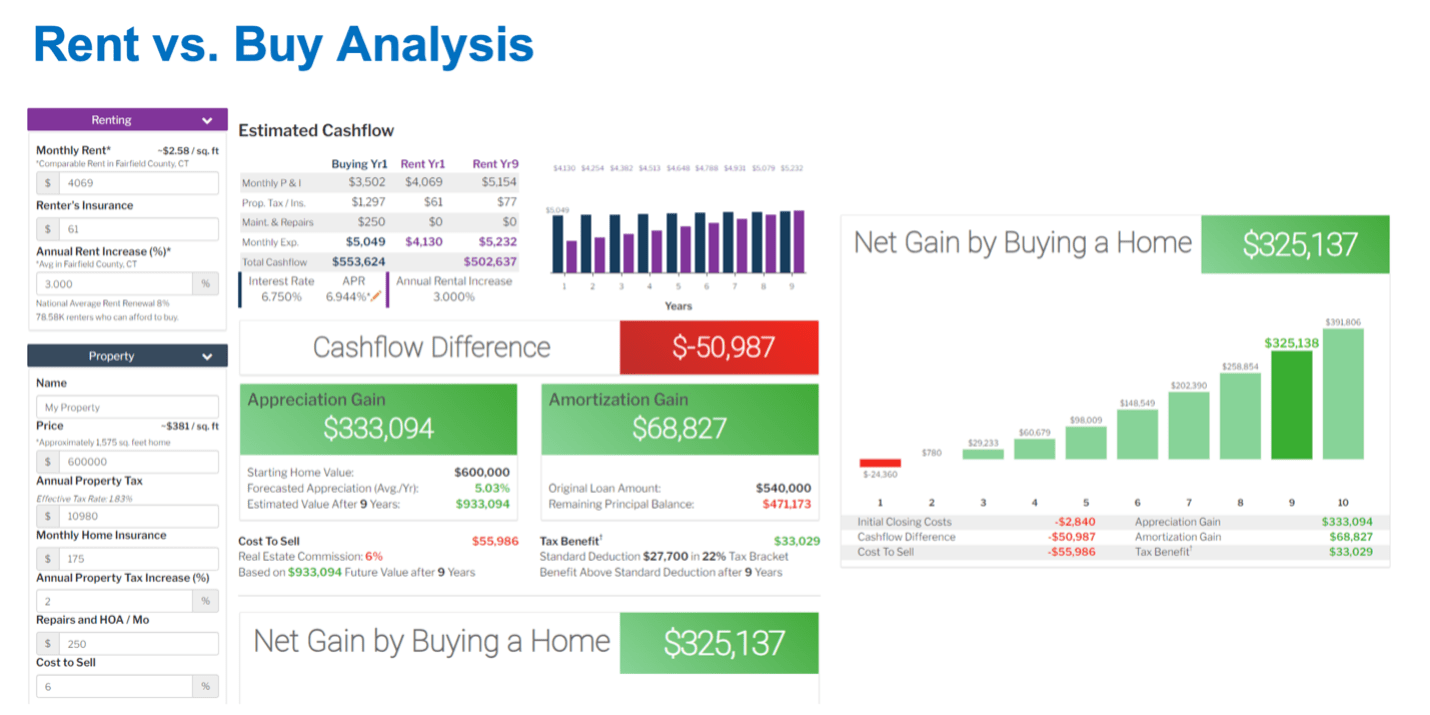

In the final chart, “Rent vs Buy Analysis” (below), we look at the case for buying versus renting using a $600,000 home purchase:

At the time of this writing there are no houses for sale in New Canaan but there is one 3-bedroom, 684 foot ranch style house for sale at 12 Wistar Court in Darien. I am reminded that as a newlywed my first purchase in New Canaan back in 1994 was for the least expensive house in town, $230,000. Our 20% down payment of about $46,000 equaled both of our salaries at the time, pretty typical. That house is now estimated to be worth $1.37 million, a gain of 600%. But when you consider we only put down $46,000 and leveraged the rest the gain is far greater. To put down $46,000 and gain $1,147,000 results in a compounded annual rate of return (known as CAGR, and more accurate than Average Annual Return) over 30 years of 6.15%.

In our “Rent vs. Buy Analysis” we calculate rent for such a house at $4,069 and the monthly expense of ownership at $5,049. While the mortgage remains constant a key assumption is that property values will increase by 5% each year, and rents will rise by and property taxes rise by 2%. With these projections this house should compound at 5% and be worth $933,094 in 9 years. The net gain for buying this home in Darien is projected to be $325,137. after accounting for appreciation gain, amortization gain and tax benefits, but deducting the costs to buy and sell.

In the past year there have been only 3 home sales in Darien under $600,000 and zero in New Canaan. Raising the bar a little, there were 15 sales under $700,000 and 2 of them were in New Canaan. They average 1,268 square feet on .29 acres and sell for $520 per foot after 82 days on the market, averaging only 92% of their asking price. They sell for 167% of their assessments which is lower than average in these markets. In a market where houses are selling on average for 100% of their list price, 92% is below average. The average home in New Canaan this month is selling in 33 days so the 64-day average here indicates this is not the most competive segment of the New Canaan and Darien markets. Finally, the 25 houses that sold in New Canaan this month averaged 202% of their assessments, with an average sold price of $2.46 million.

This week I’d like to thank Chuck Threshie of Total Mortgage cthreshie@totalmortgage.com for his support putting together this week’s charts and lending his calculations for the Buy vs. Sell analysis. For outlook on where the market is headed see my Boroughs & Burbs podcast live on Thursdays 3pm including “Uninsurable Florida” (#92) and “Greedflation” (#100) and “Halftime Market Report” (#94)

John Engel is a Realtor with The Engel Team at Douglas Elliman and is a member of New Canaan’s Planning and Zoning Commission. He is the new Real Estate Editor for The New Canaan Sentinel and his opinions are strictly his own. He can be reached at 203-247-4700 or john.engel@elliman.com.