By John Engel

On my Boroughs & Burbs podcast we did a show called “Uninsurable Florida”, episode #93. It’s fun to pick on Florida while they are having an insurance crisis. But we are all having an insurance crisis, so we did it again: episode #113 “The Changing Insurance Landscape” on luxury markets and #123 “Changing Tides” focusing on coastal communities. Insurance is beginning to have a significant influence on prices.

On my Boroughs & Burbs podcast we did a show called “Uninsurable Florida”, episode #93. It’s fun to pick on Florida while they are having an insurance crisis. But we are all having an insurance crisis, so we did it again: episode #113 “The Changing Insurance Landscape” on luxury markets and #123 “Changing Tides” focusing on coastal communities. Insurance is beginning to have a significant influence on prices.

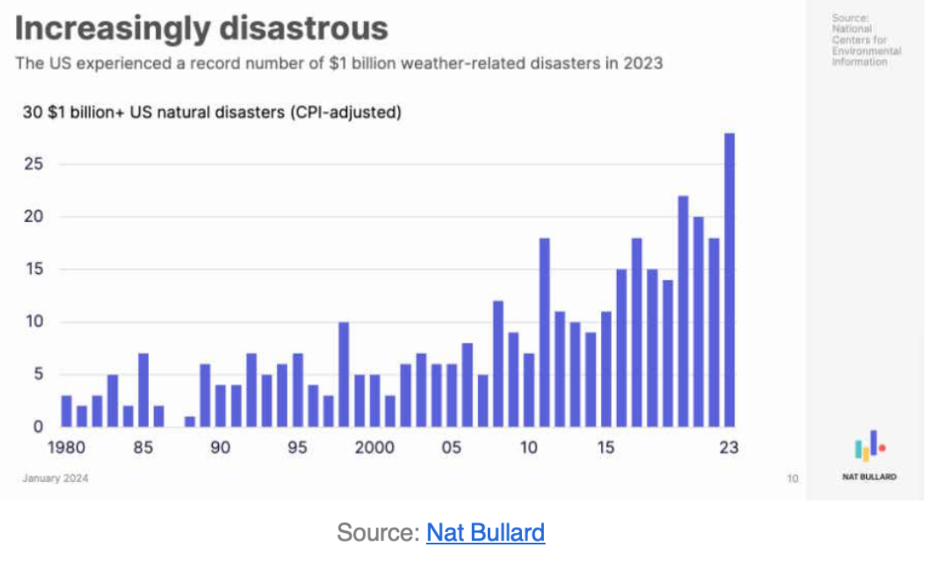

First, let’s talk about Florida. Hurricanes like Irma, Ian and Michael caused billions of dollars in damage. Ian was the second costliest hurricane in US history with as much as $60 billion in insured losses (according to Triple-I). Fraud is an even bigger problem in Florida. 80% of the nation’s property claim lawsuits are in Florida and the average cost to settle those claims is nearly $10,000. As a result of the storms and insurance fraud, seven insurance companies went bankrupt. Others (including State Farm, Allstate, and Farmers) left the state, and the rest limited the number of policies they’d write. Premiums have risen 102% since covid and are 3.5 times higher than the rest of the country. 1.2 million homeowners (15% market share) have been forced to turn to Citizens Insurance, Florida’s state-backed insurer of last resort. Now, Citizens is heading for bankruptcy and dropping hundreds of thousands of customers to lower its financial risk. It’s not getting better. This week Castle Key and Amica Mutual insurance asked Florida for a 54% increase in premiums. The net result is insurance is now having a significant impact on the Florida real estate market, affecting buyers’ ability to get mortgages. Florida homebuyers are cancelling purchase contracts after they get “astronomical” insurance quotes. It is estimated that 15% to 20% of Florida homeowners are now “going bare” by going without home insurance. It’s not just a Florida problem. 12% of the nation is “going bare”, up from 5% in 2015.

Why is this a big deal in a real estate market that just keeps rising? “You can’t have a functioning housing market without insurance, “said Jonathan Miller, president of real estate appraiser Miller Samuel Inc. “People getting mortgages are required to have it.” In Jacksonville, Florida, real estate agent Heather Kruayai said that 25% of buyers who’ve signed contracts for one of her sales listings backed out after receiving insurance estimates. More than 20% of pending homes sales fell through in September in places like Orlando, Fort Lauderdale, Dallas and San Antonio, according to Redfin.

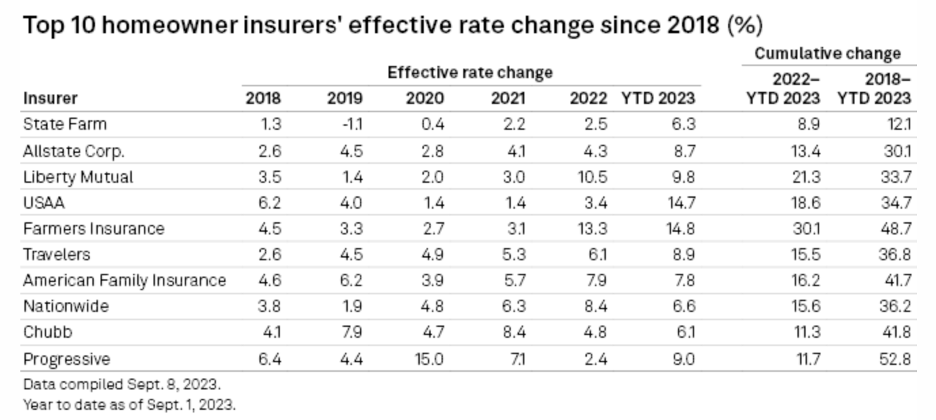

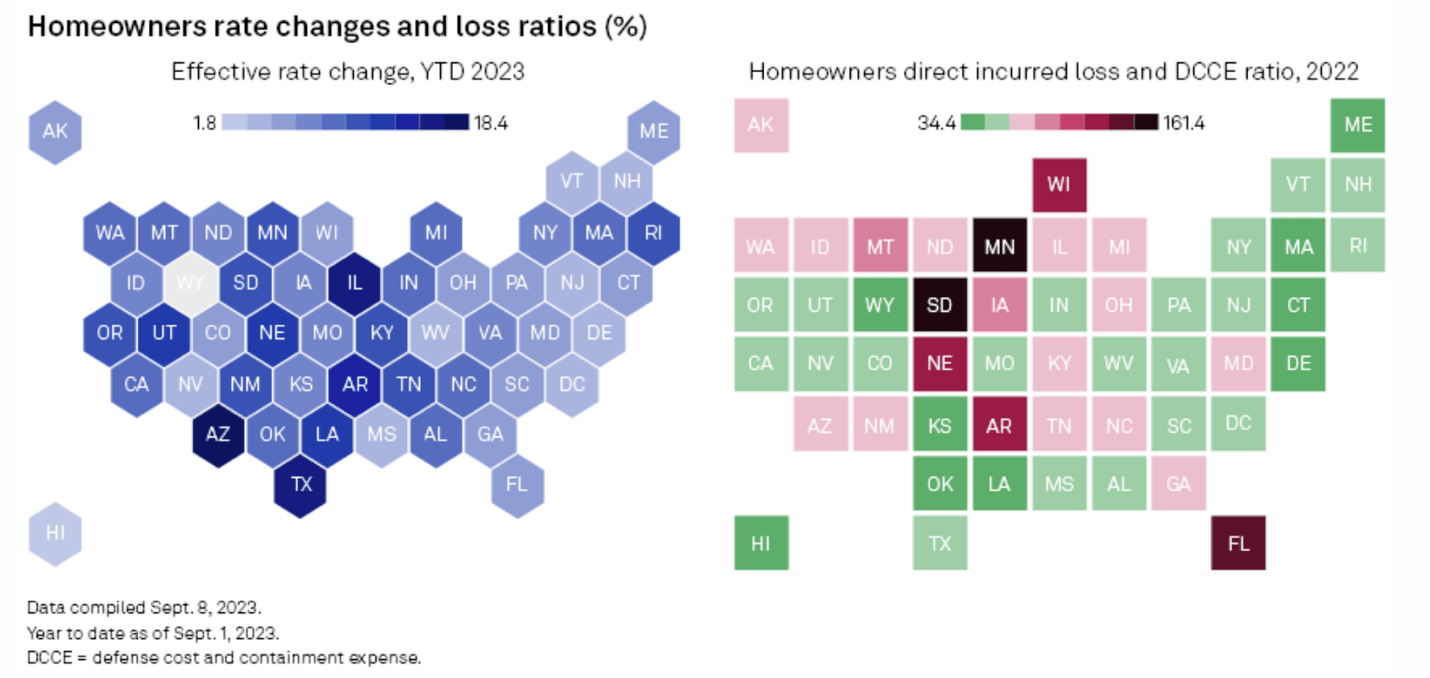

Is this a Florida problem? Not entirely. Premiums for US homeowners’ insurance jumped by an average of 21% from May 2022 to May 2023 according to a study by Policygenius. That eclipsed a 12% rise from the previous year. Why? Connecticut is not in the path of these hurricanes. “It’s the number of medium-size events that have made the impact,” writes David Marlett at Appalachian State University, “A hailstorm across the Midwest was not a big insured event, but now it seems to be a billion-dollar loss.”

So, what about in our area? One 200-unit waterfront condominium in Long Island saw its insurance premium more than double to $461,000 for this year, according to Orest Tomaselli at CondoTek. If more than 15% of a building’s owners are delinquent in their HOA payments, no unit at the property can qualify for a mortgage, according to lending rules set by housing finance agencies like Fannie Mae. That means that even if you make your payments, you might not be able to sell your unit if your neighbors aren’t making theirs.

Several insurers pulled out of the Connecticut coastal market in 2023 citing the increased cost of reinsurance. But when compared to Rhode Island and Massachusetts, Connecticut isn’t doing too badly. According to the charts provided by S&P Global Connecticut has one of the lowest loss ratios in the country and experienced only modest single digit rate changes when compared with the rest of the country.

Many New Canaan families have a home in Florida and now insurers are tying the properties together. To keep their insurance down in Florida owners are asked to make improvements up here (including a new roof). What we are learning is rates are affected by 1) a good credit score 2) the age of your roof 3) an insurance history without small claims. One way to combat rising insurance costs is through technology. Alarm systems are increasingly sophisticated, detecting a multitude of problems, and many of today’s smart homes will take corrective action, responding to the presence of smoke, water, temperature, and wind changes.

Per McKinsey, expect one trillion connected consumer devices (telematics, robotics, and drones) within the next year to streamline the process and bring down costs. Insurance is the top application for drones nationally, used for aerial data collection, underwriting, and catastrophe response, (not to mention evaluating all those fraudulent roof claims across Florida).

Notes from the Monday meeting: a New Canaan family asked if there’s any difference between listing in April versus September. The answer is yes, and no. Yes, there is sufficient seasonality in the market to make the Spring market preferable to Fall. But prices are rising, so that preference for listing now is offset by the expectation that prices are rising. The (seasonality) current might be against you, but the (demographics) tide is with you.

John Engel is a realtor with Douglas Elliman in New Canaan. Sometimes the call comes in, “We looked online for top realtors and your name came up.” Hmm. Where is that elusive list of top realtors and how do I get my name on it? Instagram followers? YouTube subscribers? Google reviews? That’s popularity, not competence. Sales volume tells us only so much. Customer satisfaction? With standardized tests at least we knew our numbers. For those keeping score New Canaan High School is still #1 in Niche but #8 in USNews. What’s in a number, anyway?