Douglas Elliman and Knight Frank have released the highly anticipated 2024 Wealth Report. These are the highlights:

First, some definitions: HNWI is a high-net-worth individual, defined as $1 million or more. UHNWI is ultra-high-net-worth individual, defined as $30 million or more. Prime property is the top 5% in any location.

Last year’s report was dominated by news that UHNWI wealth had fallen 10% because of energy, economic and political shocks. Turn the page. This year we saw a 4.2% rise in the number of UHNWIs led by growth in the U.S. (up 7.2%) and the Middle East (up 6.2%) to 626,600. Editors of the report expect that number to rise by 28.1% over the next 5 years, buoyed by particularly high growth in India (up 50%) and China (up 47%). The 38% rise in female UHNWIs is expected to continue building. Europe is home for the highest 1%.

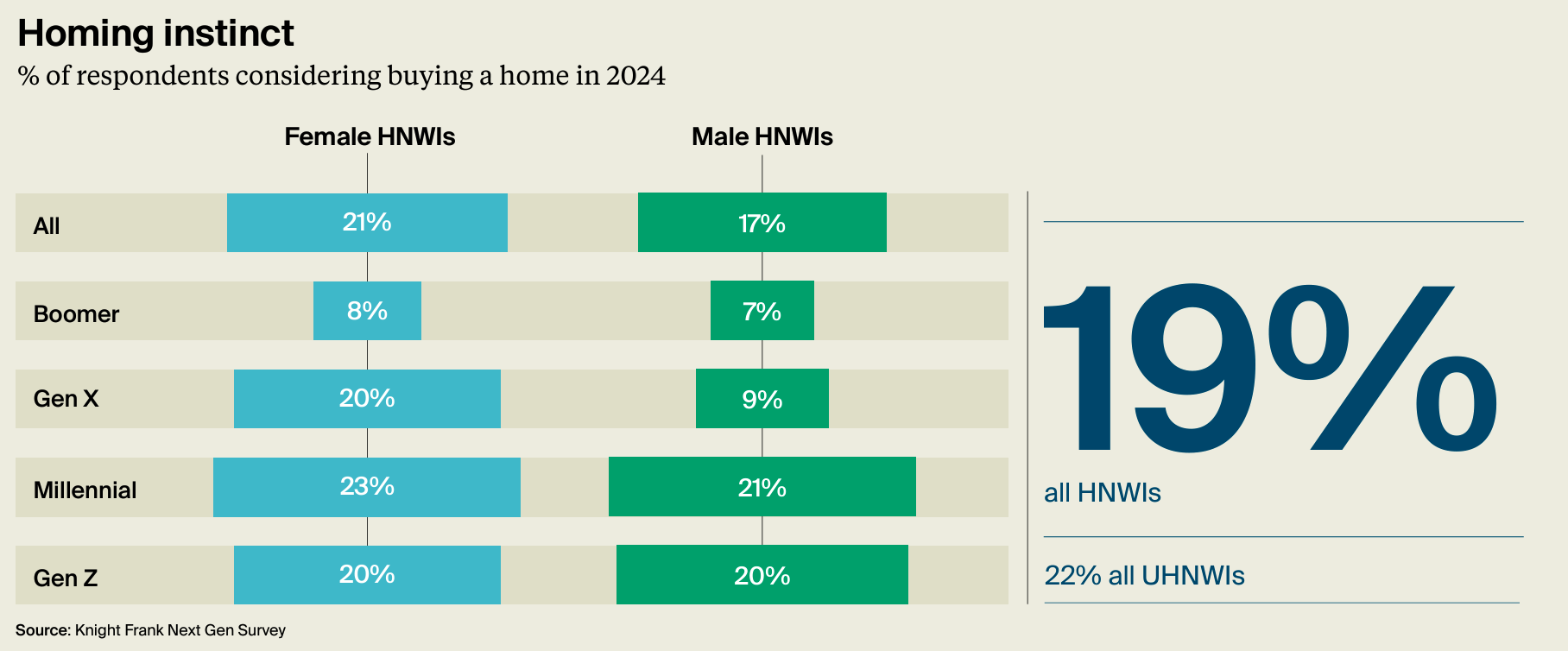

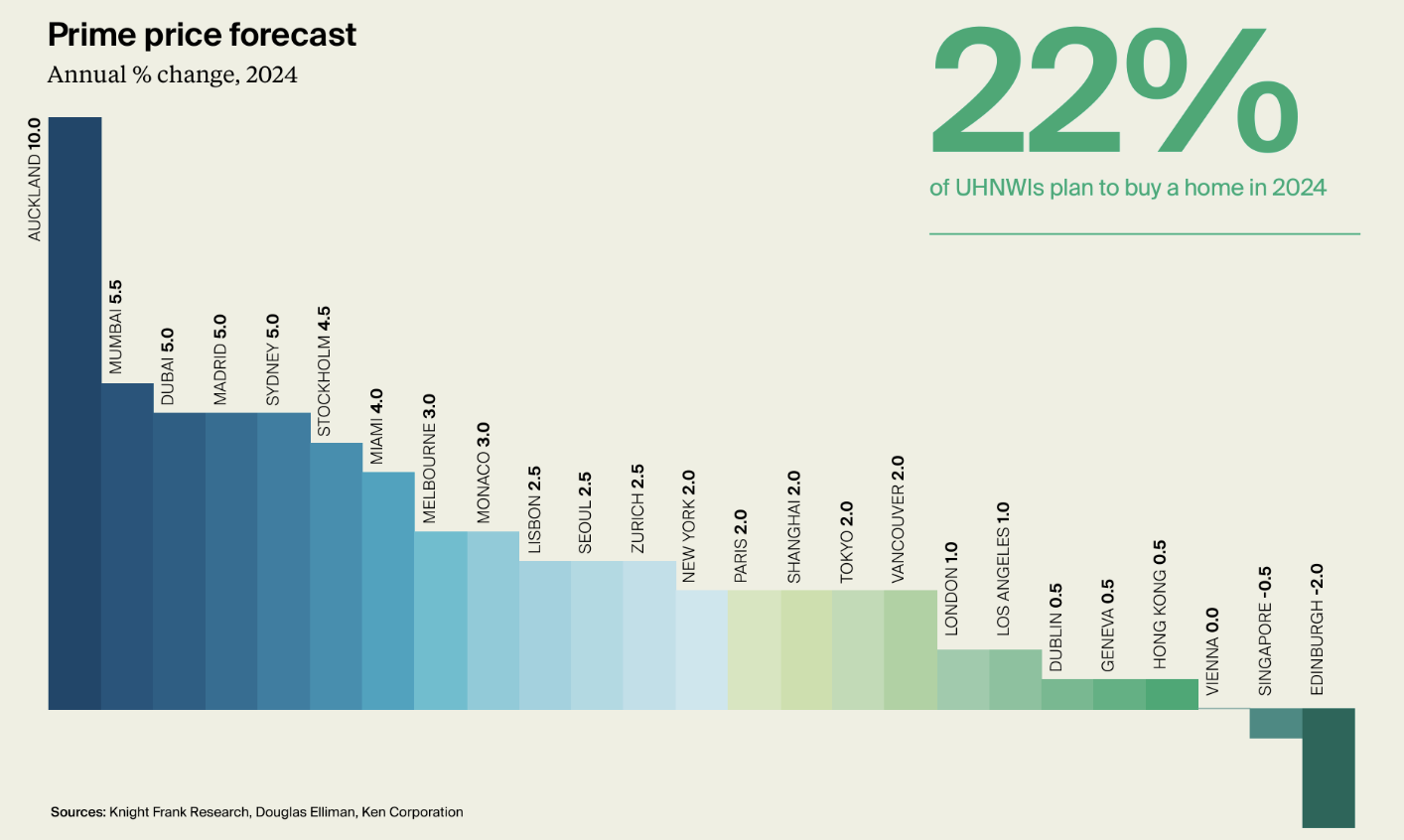

More than a fifth of global UHNWIs are planning to purchase residential real estate in 2024. Let that sink in. 22% of the 626,600 wealthiest on the planet plan to buy residential real estate this year. Unfortunately, New Canaan did not make the top ten list of places they are looking, a list led by Auckland (10+) and Mumbai (5.5%). 19% of the world’s HNWIs are expecting to buy property in 2024.

The global economy defied recession fears and grew 3.1% in 2023 and is expected to grow another 2.9% in 2024. A surge in financial market returns last year (S&P Global 100 was up 25.4%) led to a reallocation away from luxury collectibles. Luxury collectibles fell -1% in 2023 led by rare whisky (-9%), classic cars (-6%), handbags (-4%) and furniture (-2%). While art (+11%), jewelry (+8%) and watches (+5%) did well the collectibles market is significantly volatile. Here in New Canaan, we only have 2 opportunities to window-shop for our next exotic ride in 2024. Caffeine & Carburetors is scheduled for June 16 downtown and on October 20 in Waveny Park.

Bond markets experienced improved performance in the 4th quarter anticipating future rate cuts. Gold was up 15% and Bitcoin was up 155% (after crashing in 2022)

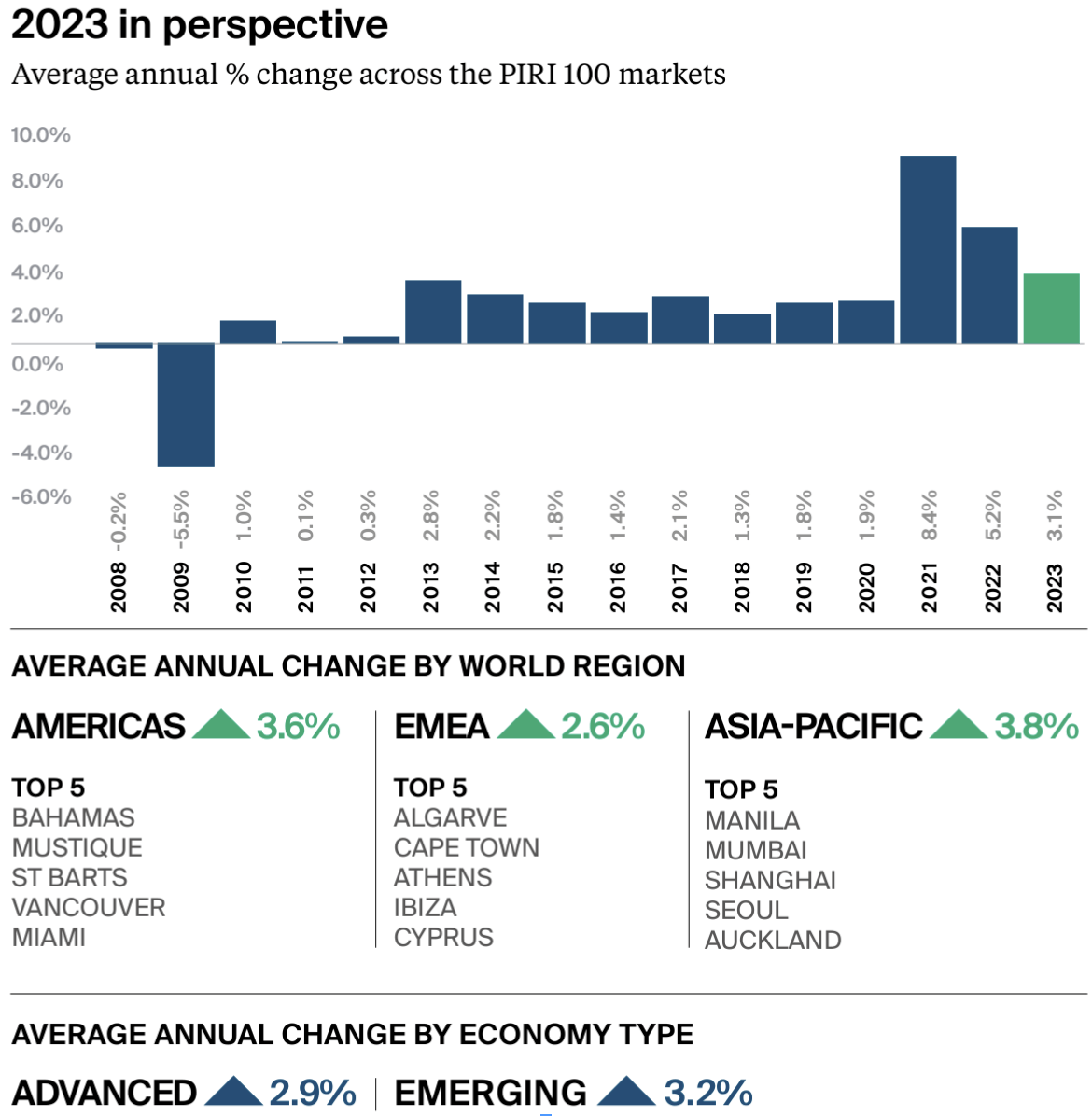

Residential capital values grew 3.1% across the world’s residential prime markets through 2023.

There is great wealth transfer taking place from the Silent and Boomer generation to the younger generations: Gen X, Millennial and Gen Z revealing changing attitudes about residential real estate, it does note that they are a more diverse group, and their wealth comes from more diverse sources, and their attitudes toward wealth and property are significantly different. As a result, new “wealth hubs” are being created and challenging the supremacy of incumbent wealth hubs such as New York and London. I reported in a previous column that the average American stays in their home 13 years before selling, up from every 5 years a decade ago. Now, we see an increasingly nomadic group of HNWIs appear happy to respond to incentives to move. The biggest reasons the wealthy move include tax, safety and lifestyle. Perceptions of a fall in living standards in major US cities, particularly safety, are offset by the challenger’s problems, such as a lack of good schools. Just as Florida and Texas are challenging New York, so too in Europe, Paris has just introduced a package of incentives to lure wealthy Londoners and their banks in a post-Brexit economy. They’ve lured 2,800 financial service jobs from London with Germany (1,800) and Dublin (1,200) not far behind. The number of French bankers earning at least one million Euro surged 63% between 2020 and 2021. Milan wants UHNWIs, offering since 2017 an annual flat tax of 100,000 Euro on non-domiciled Italian residents’ (and family members’) foreign income. The number of rich people taking advantage of this doubles every year. Hong Kong and Singapore are ascendant, minting 35 new UHNWIs every day, and putting the incentives in place to attract and retain them.

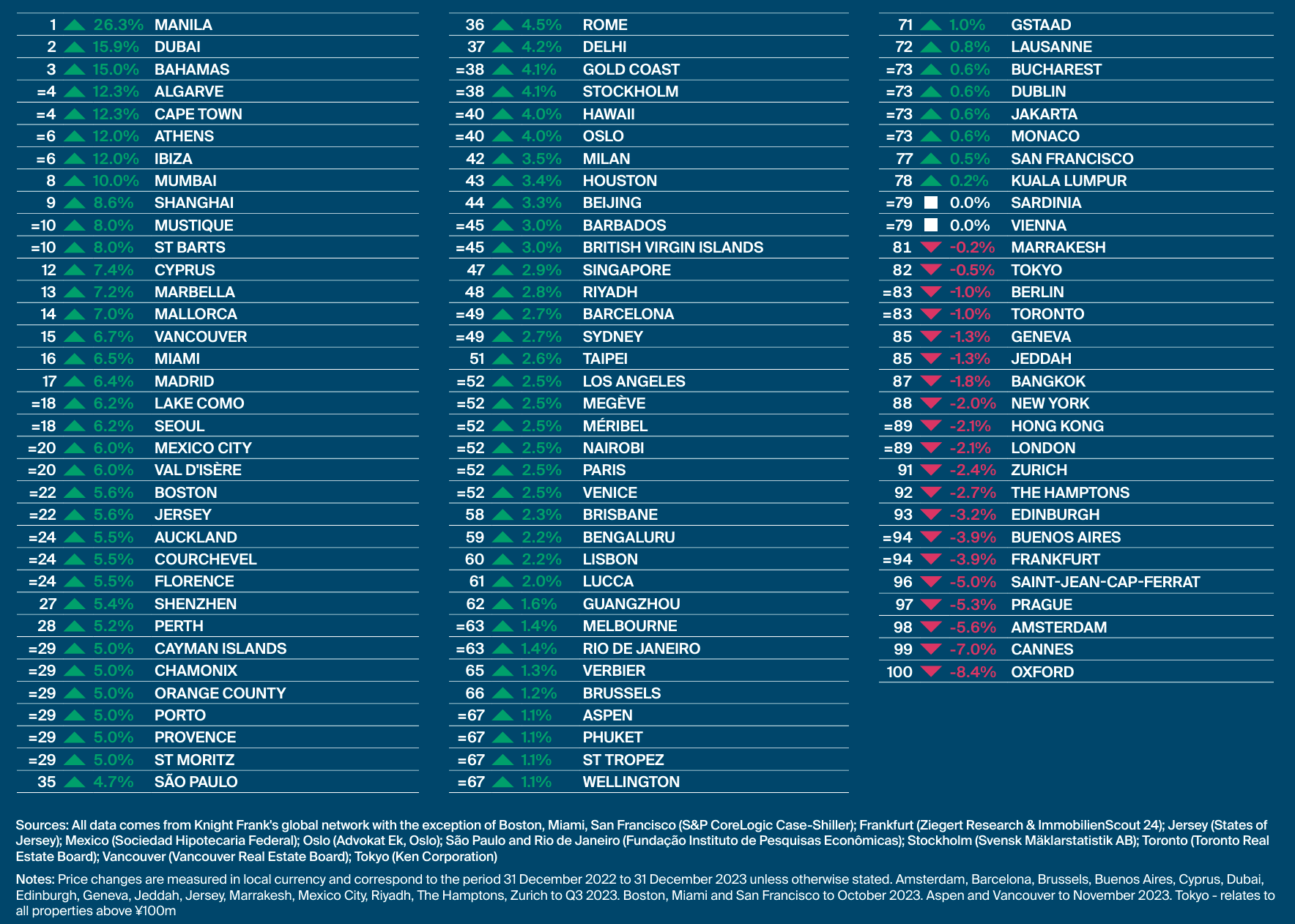

Looking at the PIRI 100, our index of the 100 luxury real estate markets across the globe, we see luxury prices climbed 3.1% on average in 2023. Sunny locations (up 4.7%) outperformed ski resorts (up 3.3%) and cities (up 2.7%). Asia-Pacific was the strongest performing region (up 3.8%), slightly above North America (up 3.6%) with Manila and Dubai #1 and #2 in the world. London and New York remain closely aligned. Prices dipped 2% in both markets and sit 8% and 17% below their most recent market peaks. Spain grabbed 5 of the top 20 spots. The PIRI 100 markets outperformed expectations a year ago with 80 recording flat or positive annual price growth. Auckland is expected to gain 10% to top the charts next year with Sydney (up 5%) and Miami (up 4%) close behind. The top 3 risks in prime markets include election/policy changes, climate risk and the lack of supply of luxury homes in these markets. The top opportunities investing in these markets stem from the relaxation of regulations, property as a diversification strategy and safe-haven capital flight.

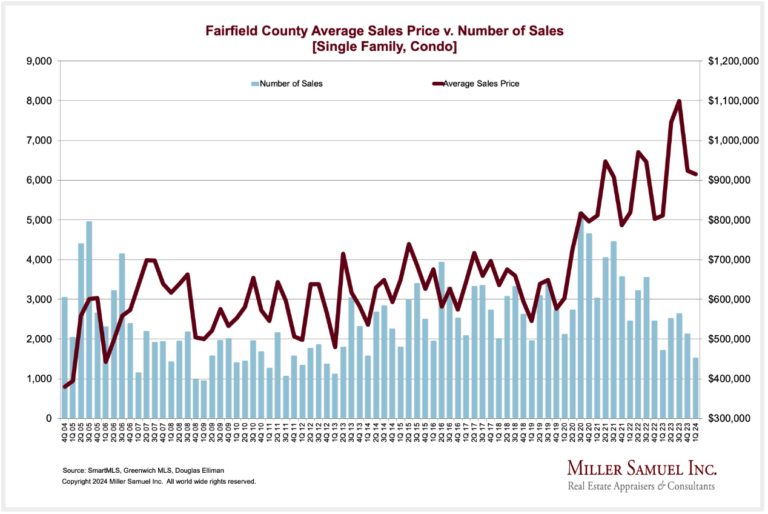

Notes from the Monday meeting: We have new agents joining The Engel Team. New agents want training and leads. The best way to learn this business is to go see the open houses with an experienced agent and talk about what you see with other agents. Unfortunately, there are so few brokers open houses and agents have gotten out of the habit. Maybe that’s why more than 50% of sales are from out-of-town agents. New listing leads are more valuable (than buyer leads) and they don’t come from New York, they come from living here and developing a local reputation. Get out of the office. Homes for sale continues to decline both in New Canaan (-40% YOY) and across Fairfield County (-18% YOY), to the lowest level in 20 years. If you are waiting for new inventory there are no signs it’s improving..

John Engel is a realtor with the Engel Team at Douglas Elliman, located at 199 Elm Street in New Canaan, next to the Philip Johnson Glass House Visitor Center. Tours begin April 15. The Brick House, newly restored by Hobbs Inc, will be open for tours May 2. There is a “secret society” of midcentury modern fans called The Grainger Society, and they get to see the Brick House early on April 25 (and a private tour of the Goodyear House) April 15. Ask John about the secret Grainger MCM handshake!

Submit questions and comments to John.Engel@Elliman.com