By John Engel

Global Shocks, Local Spin

Ray Dalio doesn’t forecast downturns; he forecasts breakdowns. “We’re not just heading for a recession,” he said. “We’re witnessing the slow unraveling of the old world order.” What he means: U.S. debt is unsustainable, trust in the dollar is eroding, internal conflict is rising, and the geopolitical advantage we’ve had since 1945 is slipping.

Larry Fink agrees. In his 2025 shareholder letter, the BlackRock CEO writes, “Persistent inflation and geopolitical fragmentation will constrain global growth.” In private conversations, Fink says most CEOs already believe the U.S. is in a recession.

Jamie Dimon puts the odds of recession at 50%, citing tariffs, inflation, deficits, global unrest, and asset bubbles. He warned of a “stagflationary environment” not unlike the 1970s.

Meanwhile, in Fairfield County, agents are quoting bidding wars and predicting a hot spring market. It’s as if none of this is happening.

Why the disconnect? Blame psychology. Daniel Kahneman called it the availability heuristic — our tendency to overweight recent experience when forecasting the future. A few strong closings in March and the phones start ringing. But this isn’t a recovery. It’s reflex.

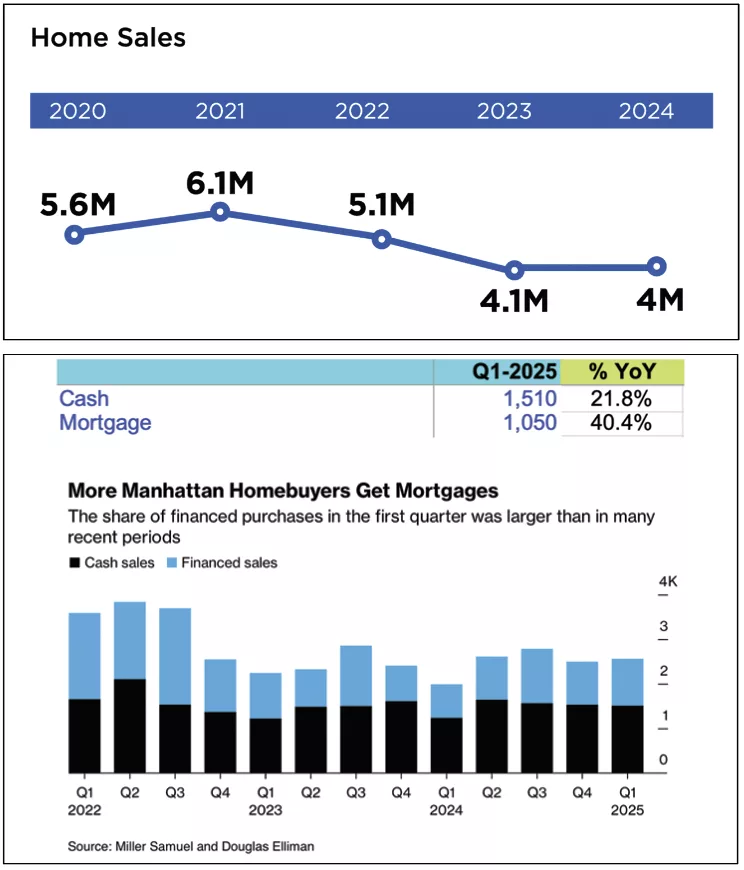

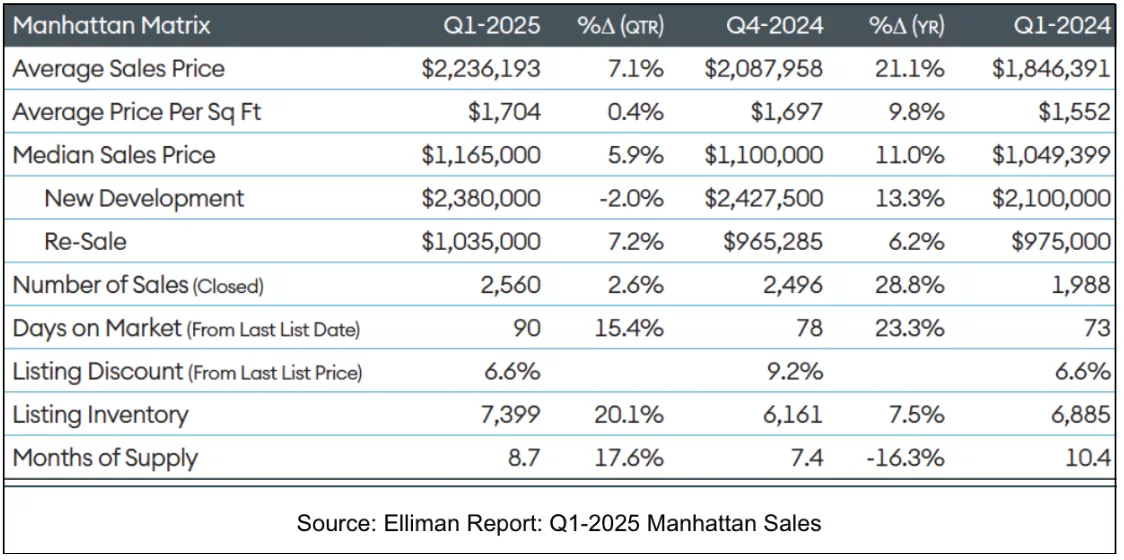

New York City — Not Falling, Not Rising

Jonathan Miller calls Q1 2025 “a return to zero.” Not collapse. Not growth. Zero. Manhattan’s average luxury sale price rose to $10.3M, but that’s because the average size rose. Price-per-square-foot? Flat.

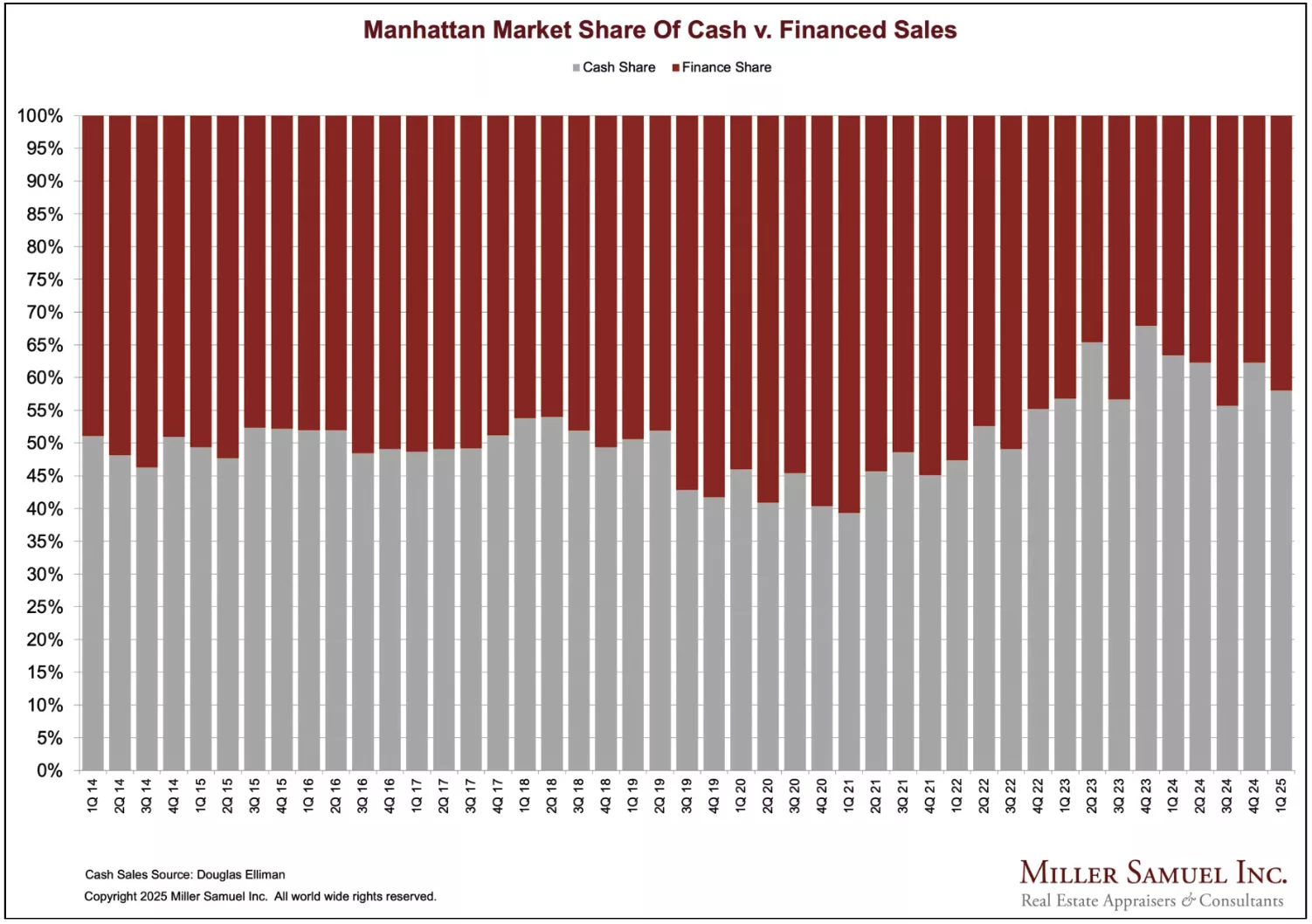

Inventory in the top 10% fell 24.1% year-over-year. Cash deals dominated: 58% of all transactions, 90% for properties above $3M. Still, bidding wars accounted for just 5.4% of sales — no different from last year.

So is this a good time to buy? Roberto Cabrera thinks so. He’s no cheerleader — he’s co-host of Boroughs & Burbs and one of the sharper NYC minds. His take: inventory is tight, demand hasn’t disappeared, and buyers who wait for lower rates will pay higher prices. Cabrera calls this “the eye of the storm” — calm for now, but unlikely to last.

History supports him. New York doesn’t recover by accident; it reinvents. In the late 1970s, Ed Koch faced near-bankruptcy. He kept the lights on and laid the groundwork for housing development. Giuliani cut crime and balanced the budget. Bloomberg rezoned 40% of the city, built Hudson Yards, greenlit Cornell Tech, and backed the construction or preservation of 165,000 housing units between 2004–2013.

What followed? A wave of capital. Foreign buyers. Private equity. Wall Street bonuses — $28.5 billion in 2006; $33 billion in 2021. Tech migration. Low rates. The myth of NYC as “bulletproof” was built during those booms.

Roberto, that myth is wobbling. Office occupancy is still stuck below 60%. Metro-North ridership is down 32% from pre-pandemic highs. The hedge funds are relocating. Related is building “Wall Street South” in Palm Beach. The Texas Stock Exchange (TXSE), backed by BlackRock and Citadel, launches this year.

When New York Sneezes…

You’ve heard it: “When New York sneezes, Connecticut catches cold.” True. But the inverse is also true. When capital leaves New York, it doesn’t disappear; it moves.

SmartMLS reports that New Canaan’s median sale price in February hit $2.9M, up 31.8% year-over-year. Price per square foot rose 13% to $494. Dollar volume surged 69% to $30.6M. Months of supply: 2.2, down from 2.9 the year before.

Days on market fell to 15. The list-to-sale price ratio hovered at 100%, even as rates held above 6.75% and jumbo financing tightened.

But this isn’t about rates. It’s about trust. Buyers aren’t chasing appreciation. They’re chasing insulation. Privacy. Liquidity. In a world where you can’t trust the Fed or the headlines or the banks, a $3 million house in a AAA-rated town with 99.8% tax collection starts to look like the safest asset in America.

This isn’t a rally. It’s a relocation. A capital flight from complexity to simplicity. From city to cul-de-sac. It’s defensive.

And here’s the warning: If you think this is bullish, you’re reading it wrong. Inflation isn’t going away. The Fed may raise again. If rates touch 8% and lending tightens, the 2025 market could stall. Sellers hoping for 2025 to be “the year” should sell in 2025.

John Engel is a broker with Douglas Elliman in New Canaan and these opinions are his own. The online version contains hyperlinks to the articles and charts referred.