By John Engel

“How’s the market?” It’s the question I get asked most often.

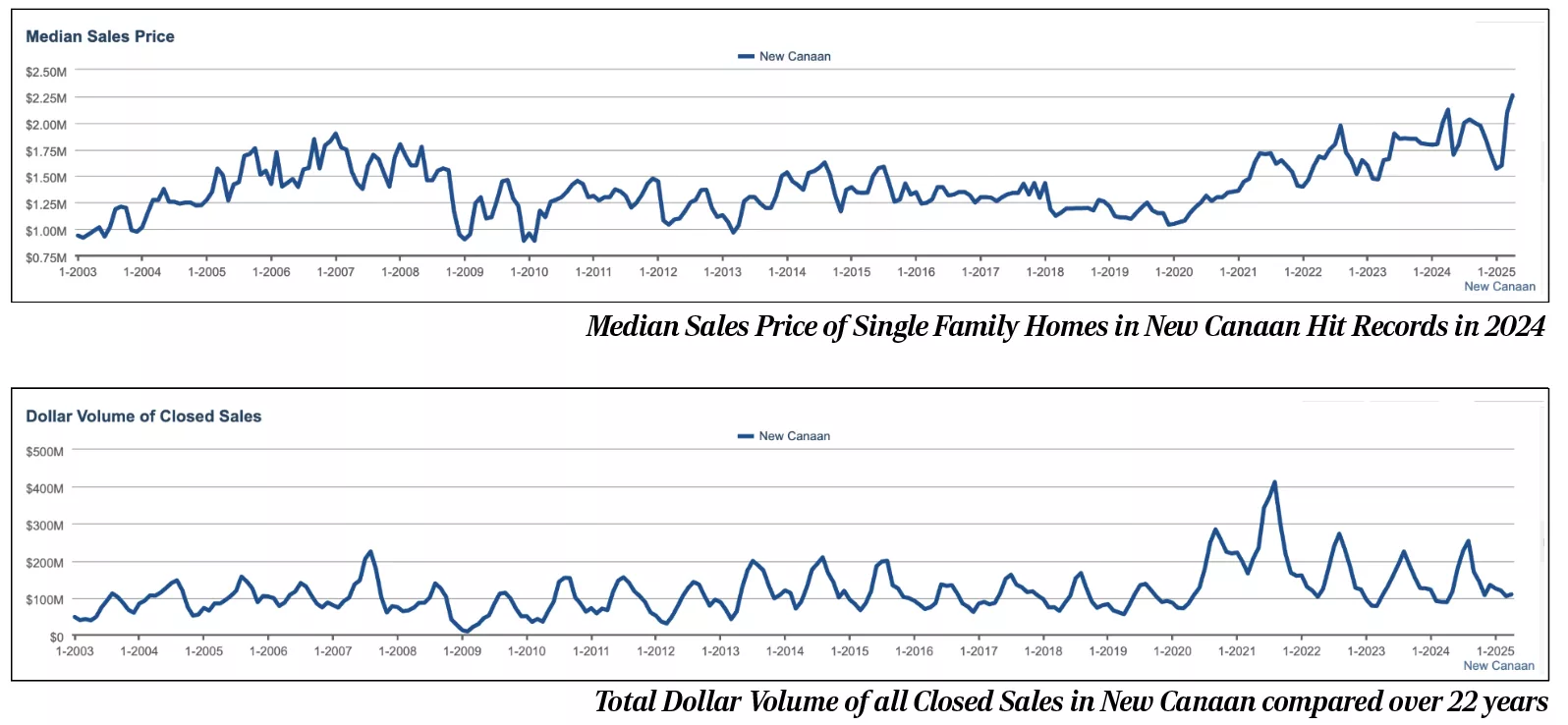

Sometimes I reach for data—graphs that show trends over time. I might point out that prices are above the highs of 2007. But that kind of information, while factual, often lacks meaning. It’s like saying the stock market is down 8% from its peak. Without context, that number doesn’t tell you whether things are improving or sliding further.

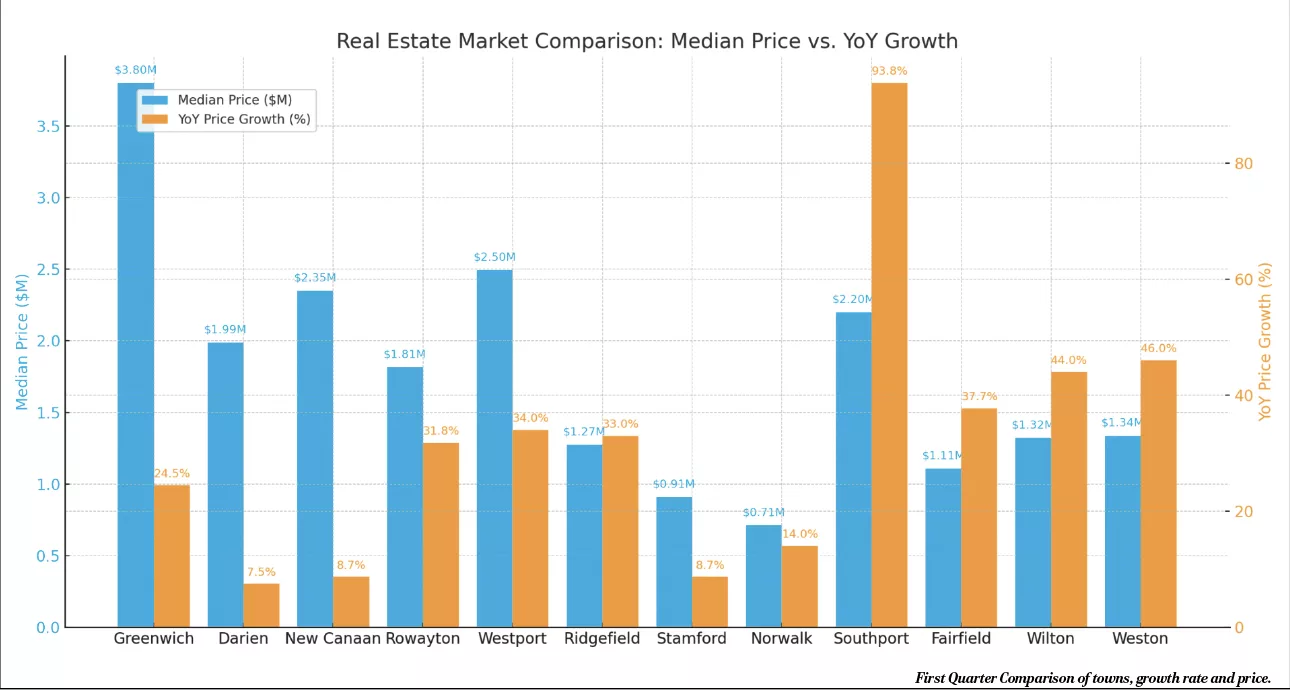

Other times I answer with comparisons across Fairfield County. If New Canaan is up, but Darien is up more, what does that mean? If Westport is only “a little up,” it might be because they surged years ago and are now coasting on momentum. Picture the housing market like the Kentucky Derby—some towns sprint early, others pace themselves, and buyers follow value when leaders fade.

Often, though, the answers come in the form of hard numbers: price per square foot, median sale price, days on market. These are the absolutes—easy to cite, easy to misread. They simplify a complex reality but fail to capture nuance. An average price per foot doesn’t distinguish between in-town homes and back-country estates, new construction and 18th-century colonials. Days on market? Easily manipulated by relisting or delayed status updates. And price per square foot? It ignores land value entirely—a critical oversight.

None of these statistics reflect the undercurrent of uncertainty buyers and sellers feel today. There’s volatility—an inability to predict a home’s price within even a 10% margin. Some of this stems from politics and the transition to a new administration. Some of it comes from a deeper shift: our changing attitudes toward housing itself. What once signaled permanence and tradition—furniture, finishes, location—doesn’t hold the same value for a new generation.

But if you really want to know how the market feels—how it behaves—there’s no better way than a story.

Because the market isn’t just numbers on a page or bars on a chart. It’s people walking into a house they’ve dreamed about. It’s bidders making bold offers before the sun sets. It’s agents jockeying for position, buyers reading tea leaves, and sellers deciding, in real time, what their “make me move” number is.

Make Me Move

On Thursday morning, a new listing hit the market. It had three qualities in high demand: single-level living, move-in ready, and undeniably stylish.

At 9 a.m., the first showing was a young couple—first-time buyers—represented by an agent. They had followed this house for years. They knew its every corner from past and present listings. It wasn’t just a house; it was the house. They became the early favorite.

At 10 a.m., a businessman arrived solo, hoping to save on commission by going unrepresented. He told me he’d recently made a “strong” offer on another property but lost. He couldn’t understand why. I could. The listing agent hadn’t followed up, hadn’t countered, hadn’t needed to. “She doesn’t work for you,” I explained. “Her job is to manage a frenzy, not chase every hand raised.” In a competitive environment, unrepresented buyers often sit in the back row while the pros occupy the stage.

To his credit, he moved fast—hired a buyer’s agent, engaged the listing agent, and made a same-day offer. He believed being first might give him an edge.

At 11 a.m., a third buyer toured the home with a sharp local agent. They appeared calm, casual, uninterested. But by nightfall, they had made a full-price offer and asked what it would take to shut the process down. No games, just straight talk.

By the end of day one, the top three had all acted. Two asked the critical question: “What will it take to lock it up now?” The seller, coached by his agent, named a number—tempting, but just out of reach. Both were given a shot. One buyer said yes immediately: no contingencies, flexible close, and a promise to sign that weekend.

I don’t know how many offers came in total. What I do know is that the early birds were serious. They moved fast because they knew others would wake up to the listing by the weekend. The seller, too, moved fast. “Time kills all deals,” his agent reminded him. Plane taxiing? Doesn’t matter. Decide your number. Commit. Get contracts out. Because talk is cheap; escrow is commitment.

It ended well, this one. But not all stories do. One buyer backed out, trying to recover part of the deposit. Another left after a radon test. These deals are fragile—hundreds of variables must align. Most sales do appraise these days. But there are still stumbles.

I’m often asked about “Make Me Move” prices—those numbers that make a homeowner consider doing the thing they swore they weren’t ready to do. Everyone has one, or should. Because while we may love our homes deeply, they are replaceable. And if the market calls your number, would you answer?

John Engel is a broker with the Engel Team at Douglas Elliman in New Canaan and he is thinking about his “Make Me Move” price. We can all love our homes, a lot, and maybe it’s not a convenient time to move, but ultimately every house has a “Make Me Move” number. Every house should. Because every house can be replaced. Is he wrong? Call John with your “Make Me Move” number.