By John Engel

“According to the latest S&P CoreLogic Case-Shiller Home Price Index, U.S. home prices continued to decelerate in May 2025, recording a 2.3% year-over-year gain. The 10-City Composite Index rose 3.4% y/y, while the 20-City Composite rose 2.8%. Among the 20 cities tracked, New York led with a robust 7.4% price increase, followed by Chicago (+6.1%) and Detroit (+4.9%).” — Matthew Gardner, real estate economist.

Why such a negative take, when home prices are rising at roughly the same rate as inflation — a healthy and sustainable level? New York City’s price increase is good news for our Connecticut market. Our buyers are more confident and getting even moreso when they sell their New York real estate, and evidence of that optimism is the fact that deal volume there is increasing.

“While home prices remain relatively stable on a national level, underlying market dynamics point to a sector in transition. With affordability stretched, inventory still below the long-term average, and transaction volumes subdued, the housing market is recalibrating under the ongoing weight of elevated mortgage rates and increasingly localized demand-supply conditions.” — Matthew Gardner, real estate economist.

Inventory in Fairfield County remains at 20-year lows. Transaction levels are moderately subdued despite the profound lack of inventory. Yes, here, too, the market is recalibrating as sellers get the message that we are in a healthy, if no longer frothy, market.

“The Case-Shiller index for May shows that the strongest home price growth continues to be in markets in the Northeast and Midwest, where supply is still limited or where homes are more affordable. By contrast, home prices in some Southern markets are slowing as inventory has been climbing. And home prices are also weaker in some West Coast markets where affordability has been a major constraint.” — Lisa Sturtevant, Housing Economist.

Much has been made of the impact of interest rates on affordability because it’s easy to measure and accessible. But, in markets such as New York City and New Canaan, where most purchases are cash, there are a host of factors. We can blame rising HOA fees, insurance rates, utility charges, commodity prices, labor costs, and maintenance if we want a true picture of the affordability equation.

“It is no longer a seller’s market in many places, but that doesn’t mean it is a buyer’s market or even a balanced market. The housing market is stuck, with both prospective buyers and sellers increasingly concerned about the economy and their own personal financial situations. Home sales activity is likely to remain slow in the second half of the year and overall sales could end the year at or below last year’s historically low levels.” (Lisa Sturtevant, housing economist)

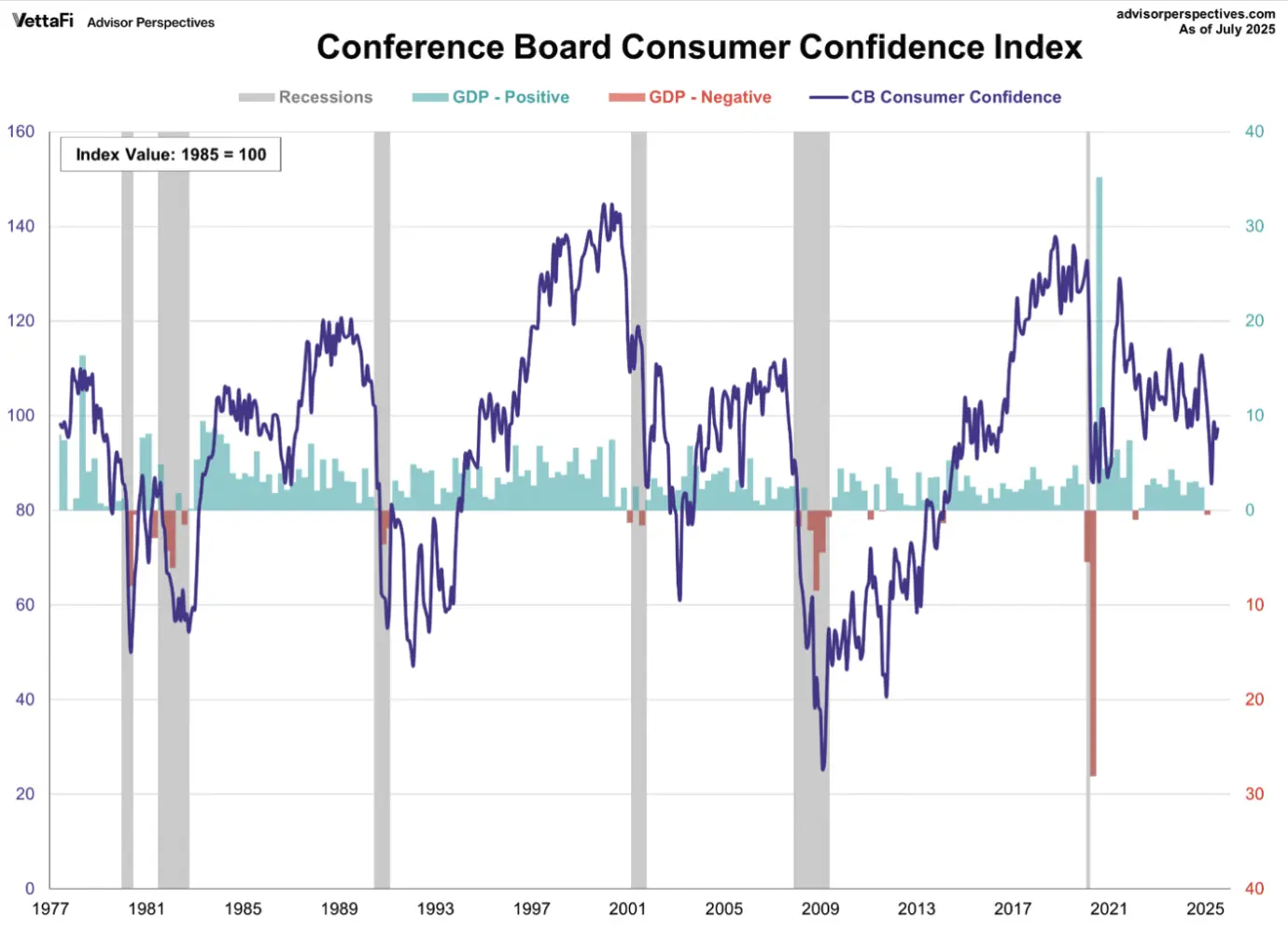

Another negative headline, and she’s not wrong, but I think the housing market is not so directly linked with consumer’s sentiment over the economy. Despite rising real estate prices in both Connecticut and New York, and a return to a more balanced market across most of America, consumer confidence has been relatively stable (at 97.2) for the three months since the April scare (when it dipped to 85). It’s also only ten points below last year’s optimism (around 108), with tariffs and jobs as the most oft-cited reasons for the decrease.

While it is easy to see dips in consumer confidence when GDP is negative, the current level is significantly below the average consumer confidence of 101.9. We need that confidence as badly as we need low rates if builders are going to build, businesses are going to invest, and consumers consume. Consumer confidence is not a great predictor of recessions, however. The last recession began while confidence was at the 132.6 level.

The national housing market is indeed in transition, as economists point to stretched affordability, low inventory, and elevated mortgage rates as forces slowing overall sales. But the local picture in places like New York City and Fairfield County is more nuanced. Price gains in the Northeast reflect strength, not instability, and in our high-equity, cash-driven markets, traditional affordability metrics like mortgage rates don’t tell the full story. Rising carrying costs — HOA fees, insurance, and maintenance — are the new pressure points. While economists emphasize buyer and seller uncertainty, I see a market that’s moving toward balance, not stagnation. In Connecticut, tight inventory and stable consumer confidence suggest that demand remains resilient, even if the froth has cleared.

Notes from the Monday Meeting:

Given the low inventory, we have several clients asking what is the likelihood that they will be able to downsize in New Canaan, Greenwich, or Darien this year. Twenty-five luxury condos sell per year across the three towns, about two per month. There are super-aggressive clients who treat this as a job, elbow their way to the front of the line, and put in the first strong offer before anyone else has a chance to see it. Conversely, there are buyers who have been looking for several years. They might makes offers but always find a reason not to move forward. These are extreme examples to illustrate a point. Some people find “the one” on the first try. Others reject “the one” because they haven’t seen enough yet, and then come back to it. A good agent educates the client sufficiently well on the last 25 sales so that the client knows exactly where the market is; thus, when “the one” appears, we both know it and have the confidence to take aggressive action.

It’s like marriage: How do you know when you’ve found “the one?” Except, unlike marriage, you can always put the house back on the market if you change your mind.

John Engel is a broker with the Engel Team at Douglas Elliman in New Canaan, and he is learning about the history oysters in Norwalk. Norm Bloom & Son, aka Copps Island Oysters, are in their 4th generation, tracing their roots to the Talmadge Brothers Oyster Company of 1875. Norm and his son operate 15 oystering boats.

We are now in the middle of the “peak spatfall window,” where trillions of larvae, which have been drifting around for 2-3 weeks in 68+ degree water, have developed a “foot” and are looking to attach to a hard shell. Once they do, they are known as spat. Two thousand spat wouldn’t fill a Dixie Cup. Next August, expect that most will be 2-2.5 inches — large enough to eat, if you like petite oysters, but legal market size means 3 inches on Pearl, the oyster boat bar at Rowayton Seafood.

That’s right: since June 1, up to 30 people can now eat Norm Bloom’s oysters on a restored 1946 oyster boat docked on the Five Mile River.